Tavia Acquisition Corp. (TAVI) | A Random Walk Through... Kazakhstan?

The Chronicles of A Mysterious Kazhak Oligarch in the US Capital Markets

“No matter how much you raise a wolf, it will always howl toward the forest. ”

Kazakh Proverb

Hi OpTrackers,

Today we’re back with a potential short idea, but admittedly more interesting than the idea itself is the backstory that leads us to the short idea. I hope everyone will find this wandering journey amusing whether or not it’s actionable for them. Who doesn’t love a ridiculous capital markets story?

Kenes Rakishev

The main character in this story is Kenes Rakishev, whose Wikipedia page you can read here. Reading the Wikipedia page you’d think he’s just an eccentric billionaire from Central Asia. He’s had his fingers in a lot of businesses and he has hobbies like chess! What’s not to love?

Maybe unsurprisingly for Central Asia, it appears that Kenes Rakishev may not be entirely on the up-and-up. Here’s a laundry list of other places he comes up:

Politics aside, he was accused of running an election interference campaign to stop Donald Trump from being elected in 2016. Whether or not this is true, you have to be in a position of power and sketchy enough for the person making the accusation to think you’re a good target.

The UK Government describes Kenes thusly: “Kenes Rakishev is a mysteriously wealthy Kazakh businessman worth up to $1.6 billion, with close ties to the political elite, and a close associate of the head of the Chechen Republic, who has been sanctioned by the US.”

Finance Scam lays out a bunch of the sketchy dealings he has been tied to here (Hunter Biden, Trump election interference, ties to the Chechen President, etc.)

And lastly, this blog lays out his history of past failed business dealing.

So let’s just suffice to say, Mr. Rakishev is probably not the type of man that you would be happy to marry your daughter.

Why Do We Care?

So why do we, humble investors in develop western capital markets, care about this obscure Central Asian oligarch? The answer is - OF COURSE - that Mr. Rakishev cashed in on the 2021 SPAC mania!

In 2021 Rakishev listed a SPAC called Oxus Acquisition Corp. (Oxus being the name of a river in Central Asia) and raised $150mm in this blank check vehicle.

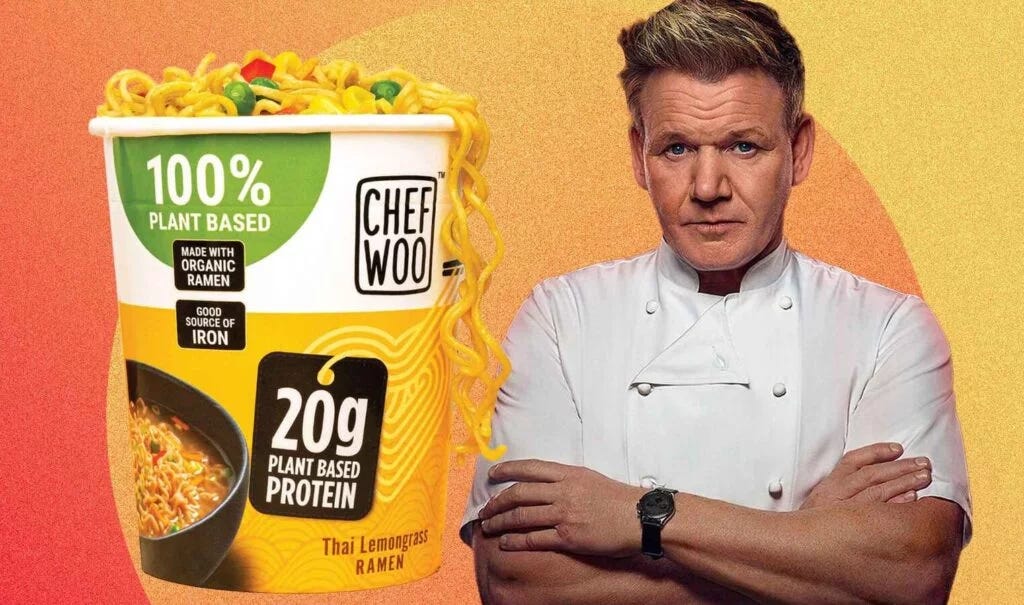

And what does this magnate of primarily banking and mining assets decide to buy? Well, in February of 2024 Oxus merges with a company called Borealis Foods which produces - and you are NOT going to believe this - a modern version of Cup-o-Noodles. And somehow this tiny, unprofitable company that no one has ever heard of got GORDON RAMSEY to endorse them.

But it gets better! If you go to Borealis’ website and navigate to the “Governance” dropdown, click on the Board of Directors tab, and then scroll all the way down to the bottom you will find that Shukhrat Ibragimov is on the board of directors.

You’ll see the first thing listed in Shukhrat’s bio is that he is on the Board of Directors of ERG. Well, ERG is one of the most notorious mining companies in the world and was the subject of a 10-year long case with the UK Series Fraud Office (honestly I have no idea what that is but it sounds bad!). Now, I will fully recognize the case was dropped due to insufficient admissible evidence, but any time a government enforcement body accused someone of bribing officials in Africa over mining contracts/rights, I tend to believe them. Make of it what you will.

So What Happened to Borealis Foods?

Here’s some quick financial highlights of Borealis Foods:

It generated $28mm of revenue in the last 12 months

To be fair, it grew 45% YoY in the last quarter

It had 17% GROSS margins in the last quarter that it reported

It has burned over $15mm in the 9 months months leading up to the last quarter it reported

It has ~$700k of cash on the balance sheet as of the last balance sheet date.

The stock is still levitating, but I think we can all agree it’s only a matter of time before this stock trades to zero.

Now, before everyone rushes out to short this thing, I should warn you that it only trades $30k/day, IBKR only has 2,000 shares available to borrow and the fee rate for borrowing the stock is >900%! Might have something to do with the levitating share price…

So, Why Do We Care?

Well, dear OpTrackers, fear not, because I am not bringing this up as purely a history lesson. For the band is getting back together!

This is the team that has raised $150mm into Oxus’ new SPAC, Tavia Acquisition Corp. (TAVI).

Kanat Mynzhanov was the CEO that masterminded the Borealis Foods deal, so enough said there.

Christophe Charlier is a serial board member who was affiliated with at least two zeroes, Agri-Fintech Holdings (OTCPK:TMNA) and Ecometals Limited (OTCPK.ETML.F).

Askar Mametov was also part of the Borealis Foods trainwreck.

Darrell Mays was previously on the board of a Navigation Capital SPAC called American Virtual Cloud Technologies which has since gone to zero.

I could go on, but I think you get the point.

TAVI is a freely trading public stock today. It appears to trade about $1mm/day of volume but I can’t find a cost to borrow for it. This is not now nor is it ever investing advice, but my hunch is you probably want to short anything these clowns touch.

It’s truly amazing what you can find when you follow sketchy people.

Happy hunting!

If you enjoy the content please smash the share and subscribe buttons below. It means the world to the me!

Disclaimer: As always please remember nothing written in this blog should be considered investment advice. You should assume that even though we tried our best that this post is riddled with errors and do your own research/consult a licensed financial advisor before investing any of your own money into any financial security