Li-Cycle (LICY) - Throw This Stock in the Recycling Bin

Hello OpTrackers,

We’re back with another short idea - today it’s Li-Cycle Holdings, Corp. (LICY).

For The Uninitiated

While there are dozens of tools available to enable the qualitative and quantitative analysis of THE BUSINESS of a potential investment, at OpTrack.io I believe there is an unmet need for analysis of THE PEOPLE that drive the outcomes of these businesses. I hope you find it helpful. If you do, please subscribe and share it far and wide. It would mean the world to me.

LICY Business Overview

The tradition of OpTrack.io is to not spend a lot of time on the actual business and per usual, we won’t this time either.

As have been several of our recent write-ups thanks to the SPAC bubble, LICY is a publicly traded science project. I assume that because there are less rules around forward projections for SPAC’s, it’s easier to sell a completely ethereal “hockey stick” future when a company goes public that way and thus they became a frequent SPAC trope. A quick snippet from the company’s latest 20-F:

“Li-Cycle’s core business model is to build, own and operate recycling plants tailored to regional needs. Li-Cycle’s Spoke & Hub Technologies™ provide an environmentally-friendly resource recovery solution that addresses the growing global lithium-ion battery recycling challenges supporting the global transition toward electrification.”

And that’s good for them, I guess. Let’s keep digging on who exactly “them” is...

LICY People Overview

Tim Johnston, LICY Co-Founder and Executive Chairman

Tim is a serial offender of the highest order when it comes to overseeing the destruction of value in the public markets.

First up we have 5E Advanced Materials (Ticker: FEAM). FEAM is a lithium mining company, so not totally unrelated to LICY. Tim was on the Advisory Board of this company from April 2021 to May 2022. This doesn’t cover much of the time it was public and thus the stock chart during his tenure isn’t that exciting:

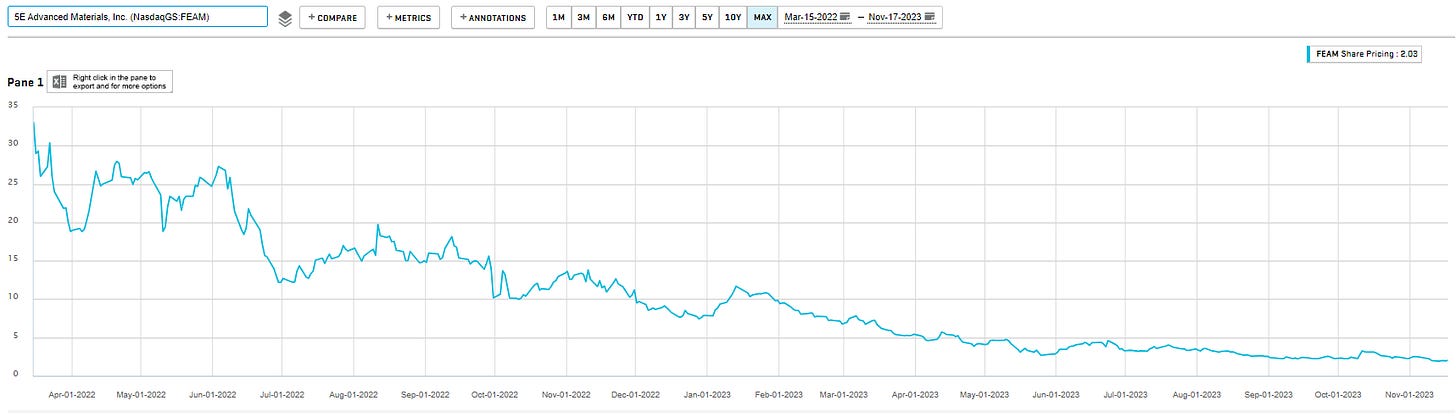

However, if you zoom out, the company pretty clearly was not on great footing at the time he stepped away. Here’s the chart from initial listing to today:

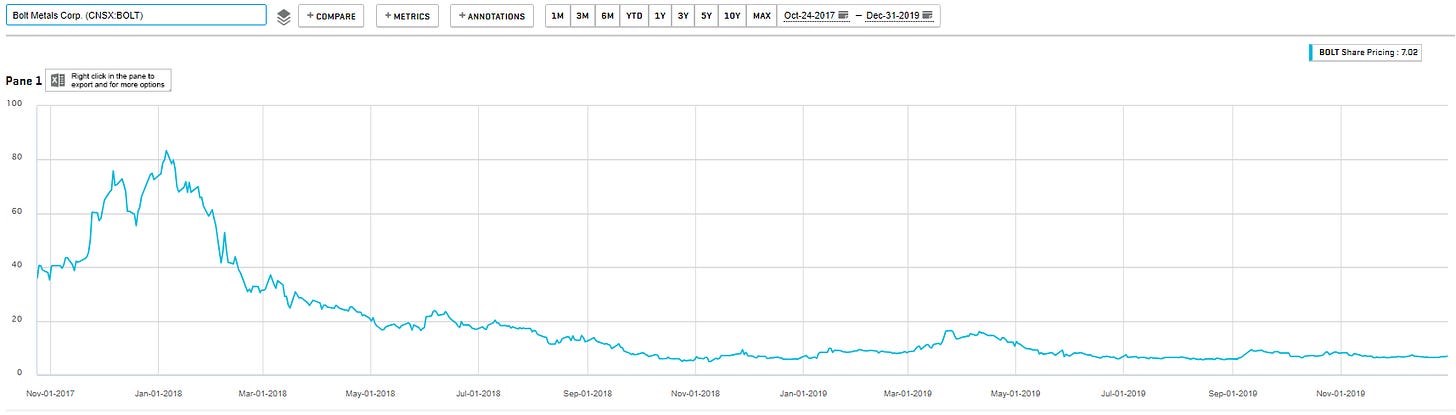

Next on the resume is Bolt Metals, Corp. (Ticker: BOLT in Canada). This was another mining company (Nickel and Cobalt, more battery-related materials) in Canada and Indonesia. And here is the stock chart during Tim’s tenure as a member of the board (the data we have says he was associated with the company from 2017 - 2019, we don’t know more specifically, but pick your favorite start and end date, it’s really kind of irrelevant):

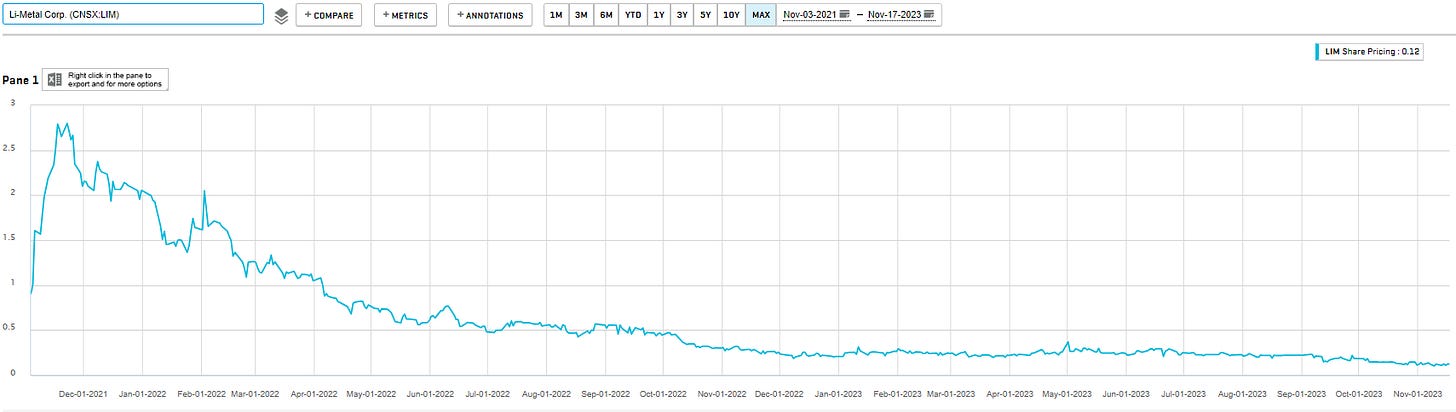

And lastly on Tim’s public company resume we have Li-Metal Corp (Ticker: LIM in Canada). Here’s the stock chart during Tim’s tenure on the Board and as Chairman:

Ajay Kochhar, LICY Co-Founder and CEO

I don’t have Ajay previously associated with any other public companies, so his background looks pretty clean for now.

However, we do note that Ajay Kochhar and Tim Johnston overlapped for a few years at a consulting firm called Hatch Associates, so they presumably have been long-time associates.

Deborah Simpson, LICY CFO

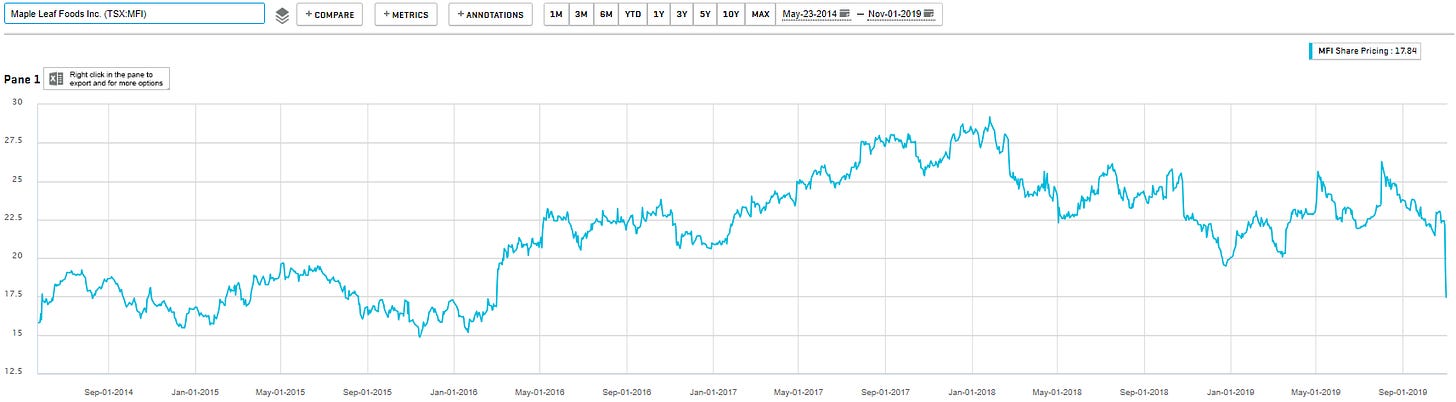

Deborah’s most significant public market experience is at Maple Leaf Foods, listed in Canada. She spent 12 years there in total, but our traditional view is to only count time periods where someone is in the C-Suite or on the Board. To that end, the performance of the company during Deborah’s tenure in the C-Suite there is below:

Honestly, not THAT bad compared to what we normally see. But generated basically zero return for shareholders in total over 5 years and Deborah resigned from her position after the company missed earnings badly. So while not damning, I’d say this isn’t confidence inspiring.

LICY Board of Directors

For the sake of time and space we’ll take a look at the LICY Board of Directors as a lightning round. Their track records may be worse than the management team as a whole. Here is each member of the board and the other public companies / roles they had there a quick summary of how shareholders have been rewarded during their respective tenures:

Mark Wellings (Lead Independent Director)

Chairman at Adventus Mining (ADZN): This is a non-cap mining company with a life-time return of worse than -50%

Chairman at Li-Metal (LIM): This is the same as the last company included above as part of Tim Johnston’s background at the beginning of this post. Reminder, the stock was down 90%+.

I would also note that clusters of the same executives moving from failed public company to failed public company together tend to have way more signaling power than executives without those past overlaps

Director at Aris Mining (ARIS): This was another mining company. Its lifetime return is something like -99.99% but he was only there for 2 years and the stock was roughly flat during that time period

Chairman at Lithium Royalty Corp (LIRC): Lithium-focused royalty company with a life-time return of ~-33% that is pretty much down and to the right the entire time and he has been there since pre-IPO

Jacqueline Dedo (Independent Director)

Director at Carbon Revolution (CREV): This company De-SPAC’d in 2023, has already done a reverse split, and is down >99%

Director at Workhorse (WKHS): The stock is down >95% during Jacqueline’s tenure

Anthony Tse (Independent Director)

Director at Li-Metal (LIM): This is the same as the last company included above as part of Tim Johnston’s background at the beginning of this post. Reminder, the stock was down 90%+.

This is now a third overlap with that failed company

Diane Pearse (Independent Director)

Diane is probably the brightest spot on this board, but (and I truly mean no offense when I say this) she looks like a career board member as she currently serves on 4 boards after having had a long career in financial roles (CFO, VP of Finance, etc.). And again, I truly mean no offense, but companies these days love having a female board member that can also check the audit requirement box (and Diane looks truly qualified on both accounts!)

Her only other public company board seat is at MSA Safety Incorporated since 2004 and that stock looks like a bona-fide compounder that has been a multi-bagger since she joined

There are two other Independent Directors, Susan Alban and Scott Prochazka, but I have nothing substantial to add on either of them.

State of the Company’s Finances

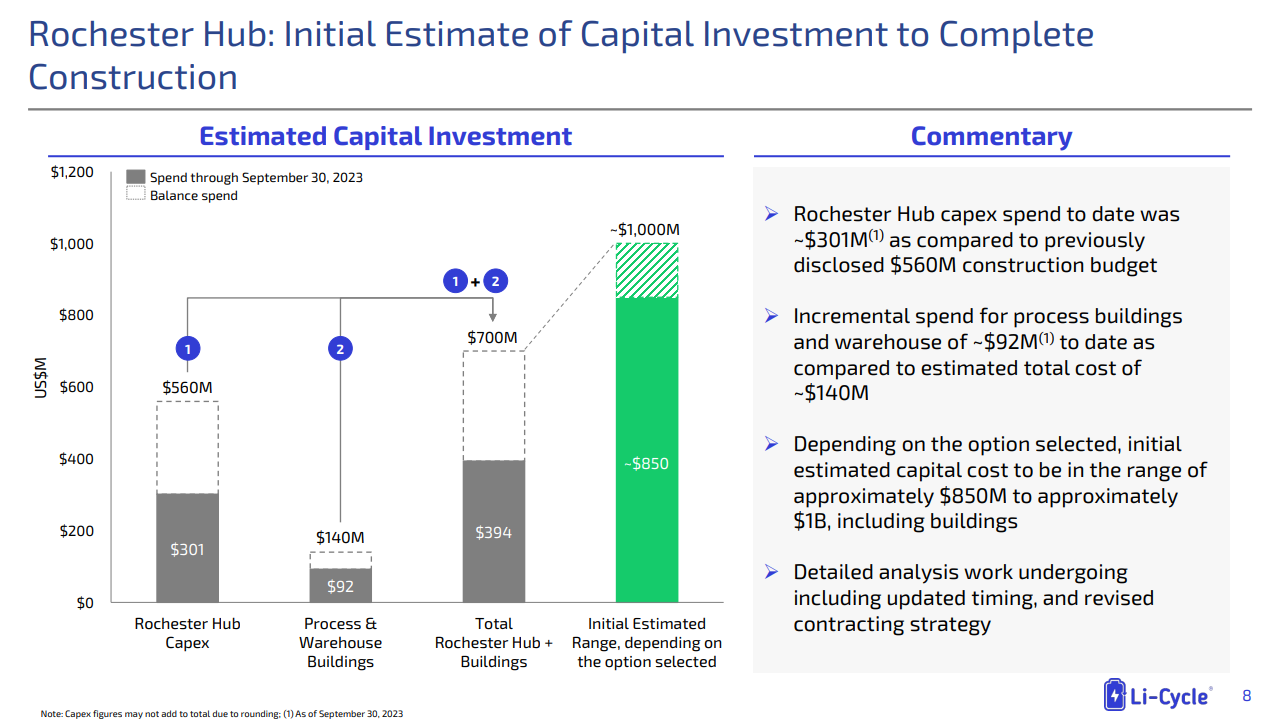

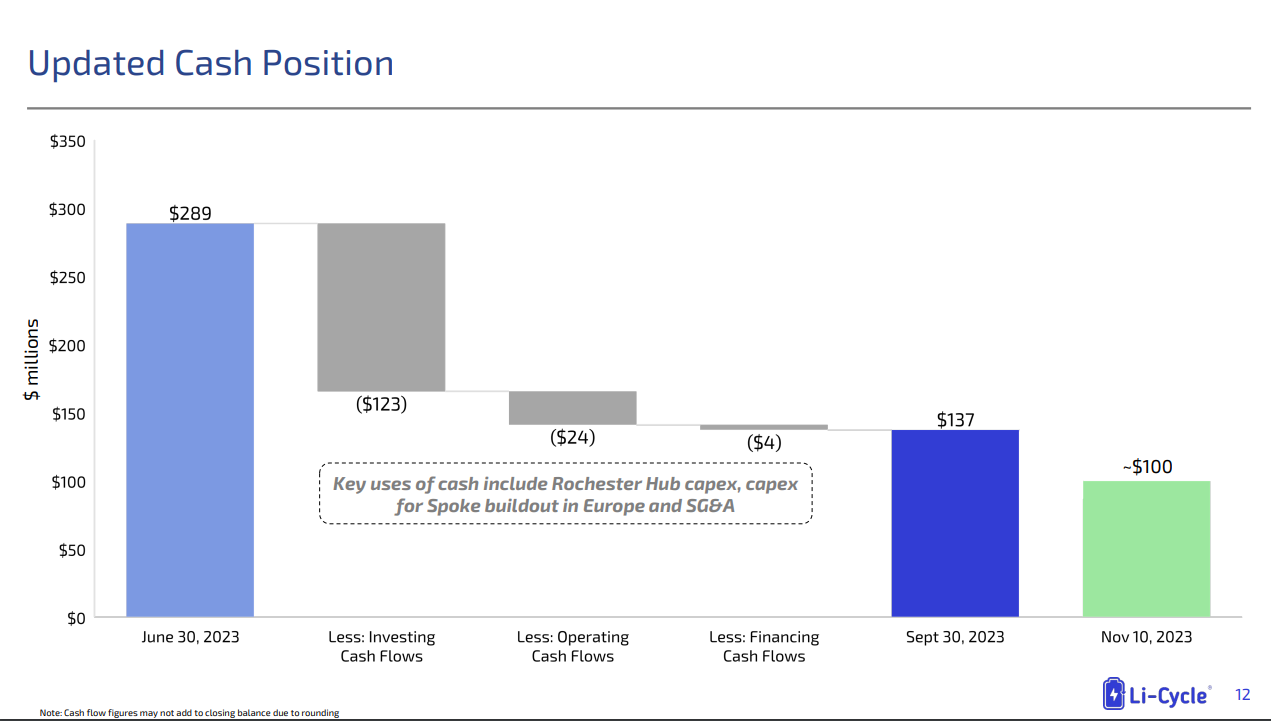

This company is in dire financial straights. It has very little capital left and cost over-runs at its facilities are massive:

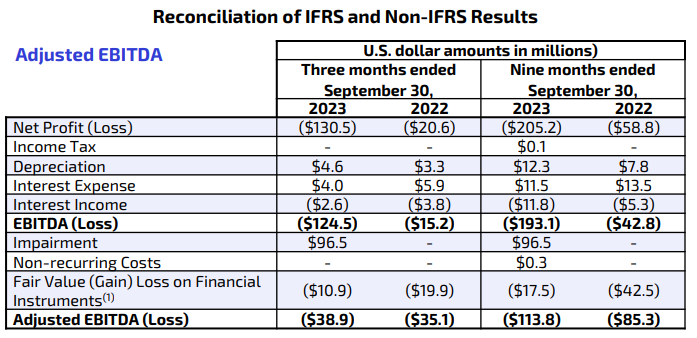

And like any good publicly traded science project, the company generates very little revenue and huge operating losses:

The company’s current market cap is only ~$100mm, so any capital raise is likely to be highly dilutive. That said, the company is in talks with the DOE about a $375mm loan, which if they get it would the company a lot of time and likely cause a short squeeze, just something to note.

In summary:

LICY is a publicly traded science project led by a management team and board with way more failure than success in their track records

Several of these executives and directors overlapped during at least one of these prior failures

The company has a horrible financial profile on a run-rate basis today

The company is also in the midst of a liquidity crisis that they need the government to bail them out of

With a low cost to borrow, this looks like a promising set up.

Disclaimer: Please remember this post should not be taken as investing advice and please consult a licensed financial advisor before making any investment decisions. The OpTrack team did its best to present everything above in a factually accurate way, but there is always room for error in biographical data on executives and market data. There may be mistakes of omission or commission in the above - if you find one - please reach out to OpTrack@OpTrack.io so that we can correct it.