Investors Should Be Cold on KULR Technology Group (KULR)

“Fugayzi, fugazi. It's a whazy. It's a woozie. It's fairy dust.”

Matthew McConaughey as Mark Hanna, The Wolf of Wall Street

Hi OpTrackers,

Today we’re going to be taking a look at KULR Technology Group (KULR).

What Kind of Company Are We Dealing With?

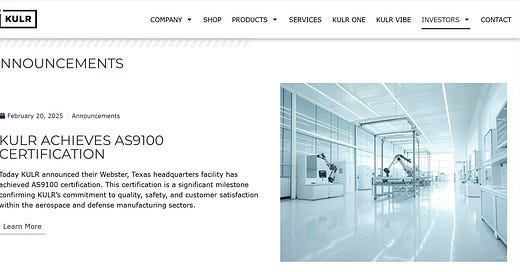

Before we get into any of the nitty gritty, I just want to set the stage for the type of company this is. If you go to the company’s news page on their website you’ll see this:

AS9100 certification!?!? And look how clean and modern and fancy it looks! Very cool… but hold on a second… what’s that in the bottom right corner of the photo?

Jesus Christ… that’s not actually a photo of their headquarter facility, is it? Just to be sure, I went to Grok to make some of my own photos:

Yupp, there it is. Grok logo in the lower right. And if you click “learn more” to see the full press release, that’s the only photo they provide. Whatever the facility really looks like, that aint it.

That’s this company in a nut shell.

KULR Technology Group Business

Honestly, I don’t believe this is a real business. They purport to have a business related to energy storage systems and ancillary products and services around it. This is from the 10-K:

KULR Technology Group, Inc., through our wholly owned subsidiary KULR Technology Corporation, maintains expertise in three key technology domain areas: (1) energy storage systems and recycling, (2) thermal management solutions, and (3) rotary system vibration reduction. Historically, KULR, focused on thermal energy management solutions for space and Department of Defense (DoD) applications, with recent expansion into energy storage and vibration reduction markets as the logical next step. Combined, this energy management platform consists of high-performance thermal management technologies for batteries and electronics, AI-powered battery management and vibration mitigation software solutions, and reusable energy storage modules.

But I don’t think any of that is capital “R” Real. As of 9/30/2024 the company has LTM Revenue of $9.7mm, LTM Gross Profit of $4.0mm and LTM EBIT of ($16.7mm). That EBIT translates roughly to LTM FCF burn of $13.6mm. And the company has $900k of cash on the balance sheet with $1.7mm of net debt.

Furthermore, for a tech company it only has $3.8mm of LTM R&D expense, 57 full-time employees, 3 contractors, and a whopping 6 patents. Something tells me they aren’t really on the cutting edge of the energy storage market.

That said, the company does have one large asset that we’ll touch on next: about $50mm worth of bitcoin.

How Is This Company Still Alive?

This company is still alive because it’s issuing equity like crazy:

Per the latest 10-Q: During the period from October 1, 2024 through November 12, 2024, the Company issued 13,045,200 shares of common stock for gross proceeds of $4,319,699 pursuant to the ATM.

That is ~6% of the 9/30/24 shares outstanding at $0.33/share (today’s price is >$1.40/share)

Per a 12/4/24 8-K: “On December 4, 2024, KULR Technology Group, Inc. (the “Company”) increased the maximum aggregate offering amount of the shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) issuable under the At The Market Offering Agreement (the “Sales Agreement”) with Craig-Hallum Capital Group LLC, dated July 3, 2024, from $20,000,000 to $46,000,000 and filed a prospectus supplement (the “Current Prospectus Supplement”) under the Sales Agreement for an aggregate of $46,000,000.”

For the uninitiated, Craig Hallum is a 3rd tier broker that routinely does ATM facilities for stock promotions. If you don’t believe me feel free to reach out, but trust me.

NOTE: ON THAT VERY SAME DAY, DECEMBER 4TH, KULR ANNOUNCES IT WILL BE PURSUING A “BITCOIN TREASURY” STRATEGY.

You’ll never guess what the stock did…

This seems to pretty clearly be a stock promote trying to create the perpetual motion machine of being able to issue over-hyped equity to fund the cash burn. And let’s not forget that the company raised $4mm on their ATM offering at $0.33/share on average a month before the bitcoin treasury idea ran the stock ran to $5/share. I get the sense that even management was surprised by the run up to $5/share.

Chief Financial Officers

In March of 2023, KULR got a new Chief Financial Officer, whose name I believe is Shawn Canter. And the only reason I qualify it like that is I am not even sure the company knows its own CFO’s name. Here’s the company’s own press release from when it was announced:

Shawn Canter replaced a guy named Simon Westbrook, who the company said was retiring. Interestingly, his LinkedIn info is included below:

First, doesn’t look like this guy is retired. Second, this is a guy with THIRTY individually listed prior work experiences and yet KULR doesn’t make the cut. My only guess is that he is so ashamed to be affiliated with this outfit he wants to scrub it from his record.

Family / (Semi) Related Parties

The CEO of KULR is a guy named Michael Mo. I believe his son is named Brandon Mo. Brandon’s LinkedIn can be seen below:

Now, Brandon’s most recent work experiences have been at Fortress Production Group and Yorkville. Fortress is in the business of social media/marketing, which seems like an odd fit for a business with KULR, but its website lists KULR as a client:

Maybe it’s not a big client because KULR does not list any related-party transactions in its SEC filings. Or maybe they are able to get around the related-party disclosure in some other way (Brandon may not own a controlling stake in Fortress?) but regardless, it smells pretty wasteful.

And then what do you know, Yorkville also shows up in the company’s most recent 10-Q:

Per LinkedIn, Brandon Mo started his internship at Yorkville the month after KULR entered into a business arrangement with Yorkville.

Wrapping It Up

I could continue:

The company has a pretty terrible auditor

The insider compensation packages at this company are hilarious

There are some individuals involved in the company’s past that are SEC sanctioned

But I will save those for another day if need be. For now, suffice it to know that this company has a >$400mm fully-diluted market cap, trades $10mm+ a day, and, thanks to the equity issuances, has only a 5% cost to borrow.

I expect they’ll continue to issue over priced equity when possible (anything above $0 is over priced) and they’ll dump that cash over and above what is necessary to keep the lights on into bitcoin, but eventually the dilutive cycle and narrative will collapse on itself, taking the stock with it.

Happy hunting!

If you enjoy the content please smash the share and subscribe buttons below. It means the world to the me!

Disclaimer: As always please remember nothing written in this blog should be considered investment advice. You should assume that even though we tried our best that this post is riddled with errors and do your own research/consult a licensed financial advisor before investing any of your own money into any financial security.