Fisker (FSR) - How to Lose A Guy (Chief Accounting Officer) in EIGHT Days

Good Morning OpTrackers,

We’re back with another short idea - today it’s Fisker (FSR).

For The Uninitiated

While there are dozens of tools available to enable the qualitative and quantitative analysis of THE BUSINESS of a potential investment, at OpTrack.io I believe there is an unmet need for analysis of THE PEOPLE that drive the outcomes of these businesses. I hope you find it helpful. If you do, please subscribe and share it far and wide. It would mean the world to me.

Fisker has been on my radar for a while now for reasons we will explore below, and I was waiting to write it up because the borrow cost is elevated but recent events have forced my hand.

FSR Business Overview

Follow an all too familiar pattern recently, FSR is a 2020 vintage SPAC with a $1B+ enterprise value despite very little revenue. Here is an excerpt from the first paragraph of the company’s business description from their last 10-K :

“We are building a technology-enabled, capital-light automotive business model that we believe will be among the first of its kind and aligned with the future state of the automotive industry. This involves innovations in vehicle development, customer experience, and sales and service that improve the personal mobility experience through technological innovation, ease of use and flexibility… Central to our business model is the Fisker Flexible Platform Agnostic Design (“FF-PAD”), a proprietary process that allows the design and development of a vehicle to be adapted to any given EV platform in the specific segment size. The process focuses on creating industry leading vehicle designs that can be adapted to match the crucial hard points on an EV platform initially developed by a third-party. This, combined with rapid decision-making, focused supply chain management and outsourced manufacturing, reduces development cost and time to market, creating a new business model for the industry and one that gives Fisker a significant advantage in bringing vehicles to market faster, more efficiently, and with more modern and advanced technology than many competitors.”

In short, the company designs, brands and markets electric vehicles, but contracts the actual manufacturing of those cars to third-parties.

FSR People Overview

Henrik Fisker, FSR Chairman, CEO, and President

Henrik seems to be a “real guy” in that he has serious experience at luxury car companies such as BMW and Aston Martin. However, when it comes to success running companies and with public companies in particular, his track record is pretty disastrous.

Henrik’s first foray into the automobile business on his own was a company called Fisker Automotive - not to be confused with the main subject of this blog post - Fisker, Inc. And Fisker Automotive ended in bankruptcy with the assets being purchased by a Chinese company, which you can read about on Wikipedia.

On the public markets side, Henrik has been involved with one other public company before FSR:

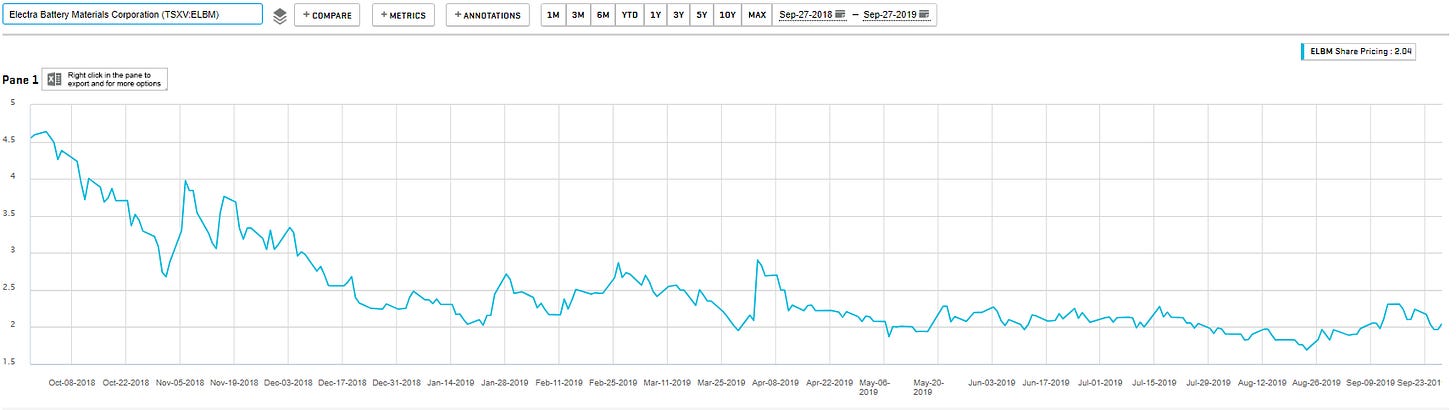

Electra Battery Materials (ELBM): This is a nano-cap mining company listed in Canada. Henrik was on the Board for exactly one year and in that year the stock fell by >50%

Geeta Gupta-Fisker, FSR CFO, COO and Director

Okay, first red flag is that Geeta Gupta-Fisker is - unsurprisingly based on the name - married to Henrik Fisker, the CEO. There is nothing outright wrong with this, but I think most people would agree it’s not exactly governance best practice.

In addition, I find it a little odd that she occupies multiple C-Suite roles plus a Director seat at the company given her degrees are in Zoology and Biotechnology. I would bet my last dollar her IQ is off the charts - she’s got a PhD in Biotechnology and Organic Chemistry - but it’s not exactly the preparation you’d expect for the CFO/COO of a publicly traded automotive company.

Additionally, Geeta has not been associated with a prior public company that I can find. Again, nothing wrong with this per se, but it sets a higher bar when evaluating the rest of the company.

Recent Events Surrounding the CAO Role

Recently, the role of Chief Accounting Officer has been a bit of a revolving door at Fisker. Here’s the rough timeline:

On September 19th: The company’s then-CAO, John C. Finnucan IV announced he was going to resign from the company in order to become the CFO of a different company.

November 6th: FSR announces the appointment of Florus Beuting as CAO. He was previously the CAO of PLBY for 2 years and before that the Controller at NBC Universal for 4 years.

November 13th: FSR announces they will be delayed in filing their next 10-Q because of the recent appointment of the new CAO. In addition, the company mentions that they have identified material weaknesses in the company’s internal control over financial reporting.

November 14th: Just EIGHT DAYS after being appointed, Florus resigns from his position as CAO, effective immediately.

What exactly happened during those 8 days? I’d really love to know. My guess is: nothing good.

In this case, I don’t have anything positive or negative to tell you about the two guys who occupied and subsequently left the CAO role. The point here isn’t that their CAOs are good or bad as much as the job seems to be a revolving door. And this is in the broader context of the CFO being married to the company’s eponymous CEO and not having a financial/accounting background. That’s not a good sign.

Other Interesting Related Party Notes

These are verbatim from the company’s proxy:

Sunil Gupta, the brother of Dr. Gupta-Fisker, currently serves as a director of our subsidiary in India, Fisker Vigyan India Private Limited.

Mr. Gupta was added to the board of Fisker Vigyan India Private Limited in March 2022.

Louise Truelsen, the sister of Mr. Fisker, currently serves as senior manager - facilities, Europe Operations.

Ms. Truelsen joined Fisker in April 2022.

Natasha Fisker, the daughter of Mr. Fisker, serves as senior manager, events and social media. Ms. Fisker joined Legacy Fisker in 2017.

Bill McDermott, FSR Independent Board Member

I do feel obligated to mention that Bill McDermott is on the board of Fisker. Bill was previously the CEO of SAP and is currently the CEO of ServiceNow, two absolute home-run technology companies. In addition Bill has been/is on the boards of several large, successful companies. In short, Bill is associated with Fisker and Bill is a winner. And this is to the company’s credit.

That said, he’s a big, well-known personality involved in a lot of things and may be over-boarded given his day job is no easy putt. In addition, the most formative experiences of his career don’t have a lot of relevance to Fisker’s business.

State of the Company’s Finances

The totality of the above is made all the more troubling by the company’s finances. FSR has $1.2bn of gross debt, $500mm of gross cash (and so $700mm of net debt) and consistently burns $100mm/quarter.

Additionally, the company just recently slashed their FY delivery guidance by 30% to only 13,000 - 17,000 units.

In summary:

The CEO of Fisker is on his second attempt to build an eponymous automotive company after the first one filed for bankruptcy

His only other involvement in a public company led to shareholders seeing their shares decline by >50%

The CFO of the company is married to the CEO

While she is without a doubt a very intelligent person, her education and formal training does not appear to be relevant to her role as the CFO of a public company

The company has at least the aura and opportunity for nepotism, with three other family members related to the married CEO/CFO duo with roles at the company

The company lost a CAO, appointed a new CEO, identified weaknesses in internal controls related to financial statements, delayed the publishing of their next 10-Q, and lost the newly appointed CEO all in a <2 months (and the last four events all in a matter of 8 days)

Fisker is a cash burning machines with a bigly net debt balance sheet and slashing its delivery guidance

The borrow cost on FSR is pretty steep, but this looks like too good of a setup to ignore.

Disclaimer: Please remember this post should not be taken as investing advice and please consult a licensed financial advisor before making any investment decisions. The OpTrack team did its best to present everything above in a factually accurate way, but there is always room for error in biographical data on executives and market data. There may be mistakes of omission or commission in the above - if you find one - please reach out to OpTrack@OpTrack.io so that we can correct it.